What is Bull Flag Pattern: How to Use Bullish Flag in Forex Trading

Contents:

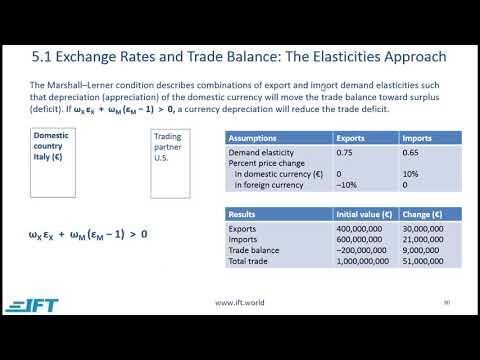

A bull flag resembles the letter F, just like the double top pattern looks like an “M” letter and a double bottom pattern – a Wletter. Once you entry a flag pattern, the targets can be derived from many indicators. The initial targets on all flag patterns will be the high or low of the flagpole. If the flagpole price peak is exceeded, then you can use Bollinger Bands and or fib price levels. To get fib price level targets, first plot the high to low and low back to high price levels of the flagpole. This should not only give the fib retracement levels but also the fib extension levels.

We use the same GBP/USD daily chart to share simple tips on trading bullish flags. The breakout occurs once the buyers reassume control of the price action after a temporary pause in the uptrend. After a series of the smaller candles, the buyers reassume control of the price action and break the upper trend line to the upside, which activates the bull flag pattern. A flag pattern also allows for two measured stop-loss levels if the stock fails to hold its momentum. The initial stop-loss can be placed under the upper trendline on uptrends and lower trendline on downtrends, as a precautionary trail stop. However, some traders may wish to give it more room to avoid wiggles and place their stop at or under the lower trendline on uptrends and lower trendline on downtrends.

Additionally, a full breakout doesn’t always happen, or instead, false breakouts occur multiple times before the pattern is actually broken, and a continuation or reversal occurs. Continuation patterns occur in the middle of a prevailing trend, indicating that the price action will likely resume in the same direction even after the continuation pattern completes. However, not all continuation patterns will result in the continuation of the trend — many will also result in reversals. The triangle pattern usually occurs in trends and acts as acontinuation pattern. The statistics on the price action patterns below were accumulated through testing of 10 years of data and over 200,000 patterns.

Support

This is identified as a period of consolidation after the completion of prices initial decline. During this period, prices may slowly channel upward and retrace a portion of the initial move. At this point traders will wait for price to break to lower lows in the direction of the trend.

If bull flag formation converge, the patterns are referred to as a wedge or pennant pattern. These patterns are among the most reliable continuation patterns that traders use because they generate a setup for entering an existing trend that is ready to continue. These formations are all similar and tend to show up in similar situations in an existing trend. First we need to find the flag pole which will be identified as our initial decline. This decline can be steep or slowly sloping and will establish the basis for our trend.

. Double Bottom Pattern (78.55%)

Again, the strongest bullish flags have corrections ending around 38.2% Fibonacci retracement level. In a bull flag formation, traders will hope to see high or increasing volume into the flagpole . The increasing or higher than usual volume accompanying the uptrend , suggests an increased buy side enthusiasm for the security in question. Traders of a bull flag might wait for the price to break above the resistance of the consolidation to find long entry into the market. Let’s evaluate how much the initial rally of the price lasted before the downward consolidation. This means that we set bull flag profit target 70 points from the point of a bullish pennant of the upper border of the consolidation.

The flag, which represents a consolidation and slow pullback from the uptrend, should ideally have low or declining volume into its formation. This shows less buying enthusiasm into the counter trend move. In an uptrend a bull flag will highlight a slow consolidation lower after an aggressive move higher.

By identifying these patterns and using them to form trading strategies, investors can increase their chances of maximizing profits while minimizing potential losses. However, it’s important to remember that no trading strategy is foolproof and that there is always a risk involved when trading in the cryptocurrency market. As such, it’s important to do your own research and exercise caution.

The anatomy of a flag formation

All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. One useful way to confirm a flag is to watch the market’s volume. In a bullish flag, volume should be high during the initial uptrend, then peter out as the market consolidates.

And, this appearance makes it a user-friendly, easy-to-identify chart pattern. It’s crucial to be careful when identifying the bullish flag in the chart and when you trade the bull flag — several important factors must be present to form this pattern. When looking at the flag on smaller time intervals, traders risk making mistakes in setting the stop-loss – the bullish flag sometimes gives false breakout point signals. Therefore it’s crucial to continuously educate yourself and seek independent advice if necessary.

Amazon Forms Bullish Pattern While Consolidating Sideways: The … – Benzinga

Amazon Forms Bullish Pattern While Consolidating Sideways: The ….

Posted: Tue, 04 Apr 2023 07:00:00 GMT [source]

The image illustrates how you would perform your analysis to arrive at a potential trading opportunity. You will see the red Flag Pole and the blue Flag channel on the chart. When you open your Flag trade, you put a stop loss below the extreme point of the Flag. When the price increases and completes the size of the Flag, you can close out 1/3 of your position size and book the profits. The take profit for the Flag pattern should be addressed using the two targets we discussed earlier. However, I would suggest taking profits at each target level to reduce risk and book profits.

The Psychology of a Flag Pattern

The All Ordinaries exhibited a pennant during a strong up-trend in October 2001. If it’s in an uptrend, you can trail it using the previous low to trail your stop loss. Alternatively, if you don’t want to use the moving average, you can use the structure of the market where you went short, and then trailing the previous high. Or you can wait for the market to break and close below the low. This means that I don’t have fixed target profits or whatsoever. For Flag patterns, I would suggest that youtry to ride the trend.

- By learning this method, you will come to know that what’s happening in the market and what’s about to happen in the market.

- For me, I like to trail my stops to ride the move as much as possible when I trade a Flag pattern.

- HowToTrade.com takes no responsibility for loss incurred as a result of the content provided inside our Trading Room.

Past performance of a security or strategy does not guarantee future results or success. You could, for instance, move both your stop and take profit as the market approaches the first profit target. Get ready to receive three amazing chart pattern videos that are over 30 minutes long straight into your inbox. Chart patterns Understand how to read the charts like a pro trader. Also, with this strategy, you don’t have to track the price dynamics. You can close the position based on the length of the flagpole.

A breakout to the upside activates the pattern, while a break of the supporting line invalidates the formation. Even if you’re sure that your flag is going to see a continuation, it’s always worth paying attention to risk management as part of your strategy. In a downtrend a bear flag will highlight a slow consolidation higher after an aggressive move lower.

- Another important consideration would be candlestick signals and the chart patterns.

- The magenta and the purple arrows measure the size of the Flag and the size of the Pole.

- We use the same GBP/USD daily chart to share simple tips on trading bullish flags.

- Testimonials on this website may not be representative of the experience of other customers.

- This is how the Flag pattern is created, and as the name implies it really does look like a flag, doesn’t it?

- The information in this site does not contain investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument.

Like other chat patterns, the flag pattern has its unique key features. Below is a detailed analysis of the main advantages and disadvantages of the bullish flag. In the picture above you can see the EURUSDForex trading pair with clearly visible elements of the bullish flag pattern.

The bull flag pattern is a piece of price action that occurs on candlestick charts after a major upward move. In a bullish flag pattern, the market consolidates between two parallel lines of support and resistance, before eventually breaking out through resistance and resuming the original uptrend. A bull flag pattern is a technical analysis term that resembles a flag. It is considered a bullish flag pattern because it generally forms during an uptrend. The “flag” part of the pattern forms when the price consolidates sideways after a sharp rally. This consolidation usually takes the form of a small rectangle.

What is the Bull Flag Pattern?

The target for a bull flag is derived by measuring the length of the flag pole and projecting it from the breakout point. To survive in trading forex, you should learn to trade with logic. There is always some logic behind every chart pattern or every trading strategy. You cannot master a trading strategy until you will learn the logic behind it. Triple tops and bottoms are reversal chart patterns that act similarly to double tops and bottoms, consisting of three peaks or bottoms , respectively. Trading volume plays a vital role in these patterns, often declining during the formation and increasing as the price breaks out of the pattern.

Apple Edges Higher As Traders Await Fed’s Favorite Inflation Data … – Benzinga

Apple Edges Higher As Traders Await Fed’s Favorite Inflation Data ….

Posted: Thu, 30 Mar 2023 07:00:00 GMT [source]

All in all, chart patterns are helpful technical indicators that can assist traders in how or why a security’s price has moved in a certain way and how its price might behave in the future. This is particularly helpful for identifying profitable entry and exit points or setting up stop-loss levels. The pennant pattern is one that you often see right next to the bull and bear flag pattern in the textbooks, but rarely does anyone talk about its low success rate. While the flag itself isn’t an exceptional pattern at just under a 70% success rate, the pennants come in well below that. As with Flags, there are two types of Pennants – bullish Pennant and bearish Pennant.

Futures and options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. This website is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results.

The sharper the spike on the flagpole, the more powerful the bull flag can be. A flag can be used as an entry pattern for the continuation of an established trend. The formation usually occurs after a strong trending move that can contain gaps where the flag represents a relatively short period of indecision.

Is Microsoft Heading Over The $300 Mark? The Bull, Bear Case For … – Benzinga

Is Microsoft Heading Over The $300 Mark? The Bull, Bear Case For ….

Posted: Thu, 06 Apr 2023 07:00:00 GMT [source]

The triple top is defined by three nearly equal https://trading-market.org/ with some space between the touches, while a triple bottom is created from three nearly equal lows. The Flag pattern is one of the most popular continuation patterns. The end of the trade would come when the GBP/USD price breaks the third Stop Loss order (S/L 3). As you see, the price reverses afterward, which would have created unpleasant conditions for the long trade.

If you have a bullish flag, you will buy the Forex pair when the price action closes a candle above the upper side. If you have a bearish flag, then you would sell the pair when you see a candle closing below the lower level of the pattern. A bullish pennant formation also follows a steep rise in the underlying asset price but may have converging trendlines when consolidating. The narrow trading range may become smaller and shaped like a triangle. Overall, both are bullish patterns that facilitate an extension of the uptrend. The aim of this article was to study in detail the flag patterns, their main advantages and disadvantages.

This objective is the polar opposite of what bearish flags suggest. Trading using the bull flag patterns is not difficult and can spur the rise of profitable traders — we know that this is a trend continuation pattern. First you need to draw the pattern in the chart, then find the optimal entry point and set a stop loss.